#Free budget software that syncs with your bank for free

But, it can be downloaded for free on the App Store or Google Play. Personal Captial can be accessed on your web browser. And, it does allow you to organize your spending and savings to generate and track your personalized budget. It can also be used for long-term financial planning. Personal Capital also offers an accurate picture of your net worth and cash flow. Of course, this isn’t merely an investment management service. But, there’s still access to human, financial advisors when needed. The reason? It uses the same algorithms as robo-advisors. If you have a 401(k), IRA or other investments to track, then Personal Capital is one of our online budgeting tools. Mint is available on desktop, as well as iOS and Android.

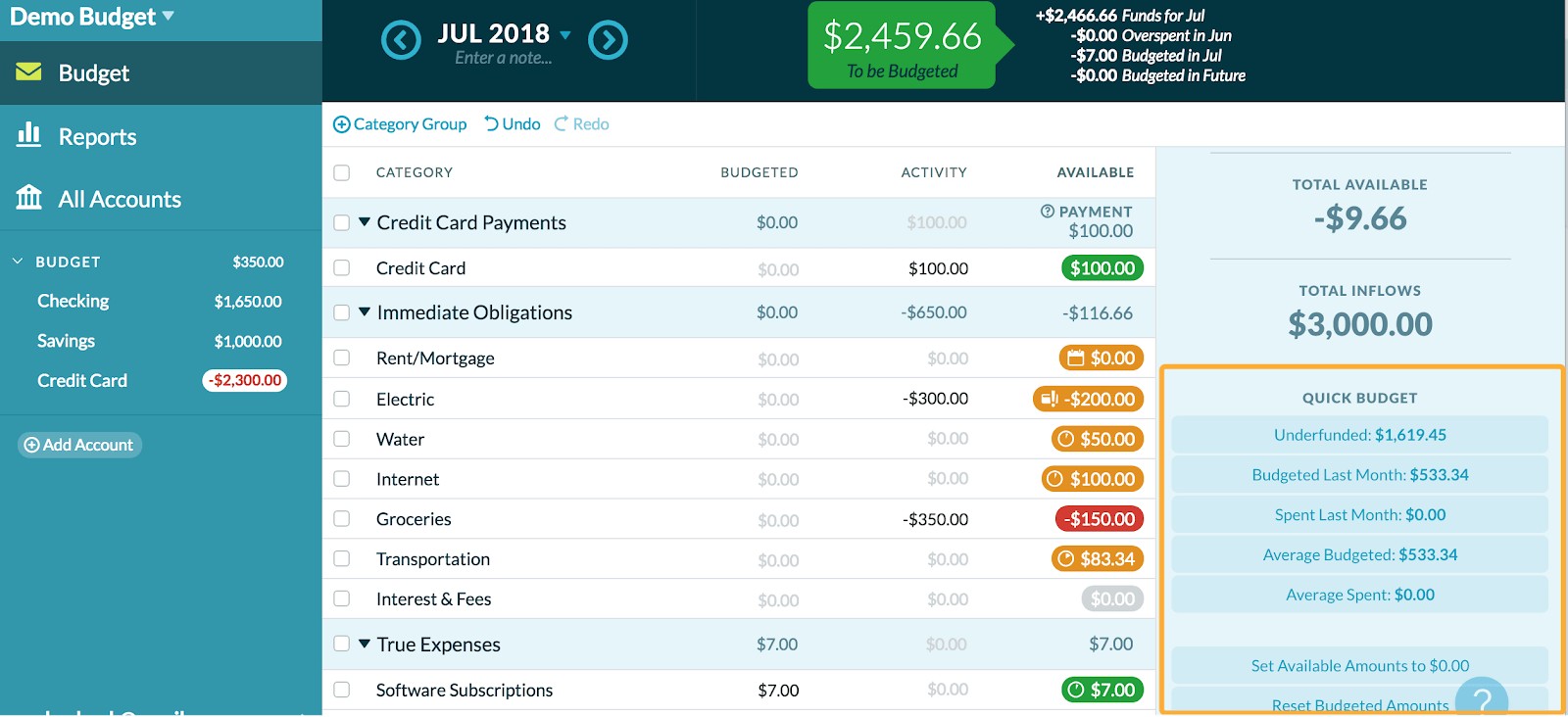

Furthermore, you’ll receive payment reminders, basic investment tracking, and unlimited credit scores. Mint will even make customized smart suggestions for you as well. From there, Mint will provide a graphical interface to see where your money is going by category.Īrmed with this knowledge, you can painlessly construct a budget. It then automatically analyzes your spending by month, quarter, or year. And, that’s because it’s packed to the brim with features.įor starters, it links all of your financial accounts, such as checking, savings, and credit cards. Since 2006 this popular platform has assisted over 20 million users smoothly manage their finances. Mintįor many, the undisputed heavyweight champion of budgeting tools is Mint. There are plenty of powerful and easy-to-use online budgeting tools that you can utilize at zero-cost, such as the following ten solutions. You can then export this data to a spreadsheet or accounting software.īut, what if these options aren’t your bag? Well, you’re in luck. For instance, Bank of America and Connex Credit Union allow their customers to track their spending and run spending reports on their sites. Or, you may have access to free budgeting tools through your financial institution. There are also helpful premade worksheets from organizations like. That means that their users do not have to create one from scratch. Microsoft Excel and Google Sheets offer free budget templates. If you want to go digital, spreadsheets are an excellent option. For example, if you place $200 in your grocery envelope, then that’s what you will spend. Here you would place a specific amount of money into an envelope so that you don’t overspend. Plus, unless you carry around a notepad, you won’t always have these materials on you when you need to add new items.Īnother low-tech and free technique is the envelope system. The downside is that they don’t help anticipate future expenses. You simply jot down your expenses and categorize them. Going old school by using pen and paper meets these criteria. What’s more, they should also be incredibly easy to use. The solution? Affordable free online budgeting tools - and by that, I mean free. And, in some cases, it makes budgeting a little less overwhelming and panic-induing. After all, these tools make it easier to create and stick to your budget so that you can achieve your financial goals. While Tayne speaks the truth, that’s easier said than done - especially when you don’t have the right tools. “Budgeting has only one rule: Do not go over budget.” - Leslie Tayne Additionally, you don’t want to use overly complex tools that generate such meticulous reports that the thought of it gives you a panic attack. In my frugal opinion, that just defeats the purpose. You don’t want to spend an arm and a leg on online budgeting tools.

0 kommentar(er)

0 kommentar(er)